Our investing approach is simple

Invest in QUALITY stocks when they are PRICED LOW

Save time, earn more, and reduce your risk by investing in the highest quality dividend stocks

Our do-it-yourself approach is based on 3 principles

INVEST IN QUALITY STOCKS

You'll see below that a quality stock is one that is profitable, pays increasing dividends to shareholders, has a low payout ratio, has low debt, and is priced low, in other words it passes all the 12 Rules of Simply Investing. When you're investing your hard-earned money it's important not to put it at risk, the 12 Rules are designed to, reduce your risk, and keep you from making mistakes.

BUY LOW

Stock prices go up and down all the time, the key is to buy when a stock is at a low price, that way you can maximize your profit by selling it later (if you wish) at a higher price. There is no point in buying a stock when it is trading at it's high price (overvalued).

GET PAID

Dividends are profits that the company is sharing with you the shareholder. If a company is paying $1/share dividend and you own 1000 shares, you will receive $1000 each year for as long as you own those shares (regardless of share price) and as long as the company continues to pay the dividend. The dividend is deposited directly into your trading account, you can spend the money if you wish or re-invest it.

A quality stock is one that passes all the 12 Rules of Simply Investing shown below:

1. Do you understand the product or service offered by the company?

2. Will people still be using this product or service in 20 years?

3. Does the company have a low-cost durable (lasting) competitive advantage?

4. Is the company recession proof?

5. Ensure the company is profitable, check the following two EPS parameters:

a. 20-year average EPS growth must be at least 8% or more.

b. The EPS must have increased at least 8 times in the last 20-years.

6. 20-year average dividend growth must be at least 8% or more.

7. Payout ratio must be 75% or less.

8. Debt must be 70% or less.

9. Has there been a recent dividend cut? Avoid companies with a recent dividend cut.

10. Does the company actively buy back its shares?

11. Ensure the stock is priced low (undervalued):

a. P/E ratio must be 25 or less.

b. Current dividend yield must be higher than its (20-year) average dividend yield.

c. P/B ratio must be 3 or less.

12. Keep your emotions out of investing.

The 12 Rules of Simply Investing are time tested and designed to keep you from making mistakes. Investing really can be this simple.

The Simply Investing (SI) Criteria is a subset of the 12 Rules of Simply Investing (shown above), it consists of Rules #5 to #11.

Rules #5 to #11 are quantitative, a stock that passes all the quantitative ten criteria achieves a maximum grade of 10 out of 10.

The Simply Investing Report & Analysis Platform automatically applies each day the SI Criteria to over 6000 common stocks in the US and Canada. However, you are still responsible for applying Rules #1 to #4 and #12.

In the Simply Investing Course, the provided Google Sheet also automatically applies the 10 SI Criteria rules after you've entered in the financial data for stocks you are researching.

A dividend stock is priced low (undervalued) when:

- it's Current Dividend Yield is greater than it's Average Dividend Yield

A non-dividend stock is priced low (undervalued) when:

- it's P/E Ratio is less than it's Average P/E Ratio

The Simply investing Platform automatically applies the above formula each day to over 6000 stocks, and shows you which stocks are undervalued and which ones are overvalued (priced high).

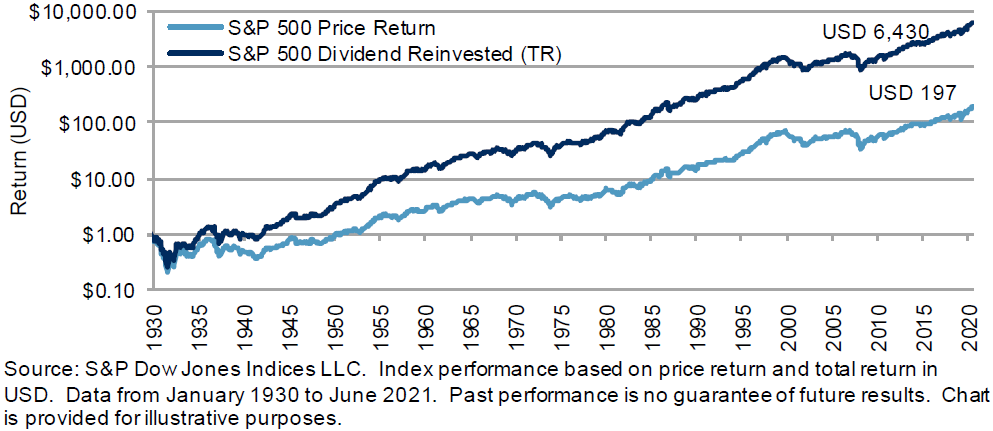

Dividends provide extraordinary returns

$1,000 invested in 1930 in the S&P 500 would be worth $197,000 (by the end of June 2021).

However, the same $1,000 invested in 1930 with dividends reinvested would be worth $6,430,000 an increase of more than 3,163%

Dividends provide a margin of safety

Dividends are paid in cash to shareholders. If a company goes bankrupt, the dividends given to shareholders cannot be taken back. $2479 invested in TRP in 2000 would have so far provided you with over $7300 in dividends alone.

Over time dividends lower your risk

Since 2000 TRP has consecutively increased it's dividend each year. $2479 invested in TRP in 2000 would have so far provided you with over $8700 in dividends alone. Each dividend increase lowers your risk.

Dividends put money in your pocket

You don't have to sell your stocks, or funds in order to receive cash. Dividends are cash payments made directly to you the shareholder. Some dividend investors are earning 20, 30, 50, $75K a year in dividends alone.

Dividends are passive income

You get paid dividends just for holding on to your shares. You do not need to work extra hard to earn dividends, they truly are passive income. Each dividend increase grows your passive income each year.

Dividends can provide double-digit returns

If you purchased shares in TRP in 2000, the share price was $13.40 and the dividend was $0.80, which means your dividend yield was 5.97%

Today the dividend for TRP is $3.72, which means your dividend yield based on your purchase price today is 27.76% ($3.72/$13.40).

Dividends offer tax advantages (US)

Outside of your 401k/IRA qualified dividends are taxed at substantially lower rates than income. For example, as per the IRS, for individuals whose ordinary income tax rate is in the highest brackets (35% or 37%), qualified dividends are taxed at only a 20% rate. And for individuals whose ordinary income tax rate is below 12% to 35%, qualified dividends are taxed at 15%, and for those in the 10% or 12% tax brackets, they pay no tax on qualified dividends.

Dividends offer tax advantages (Canada)

Outside of your RRSP/TFSA (registered accounts) eligible dividends are taxed at substantially lower rates than income. For example, as per the CRA, in Ontario you would pay $14,180 in income tax if your earned $60,000. However, if you earned $60,000 in eligible dividends you would only pay $750 in taxes.

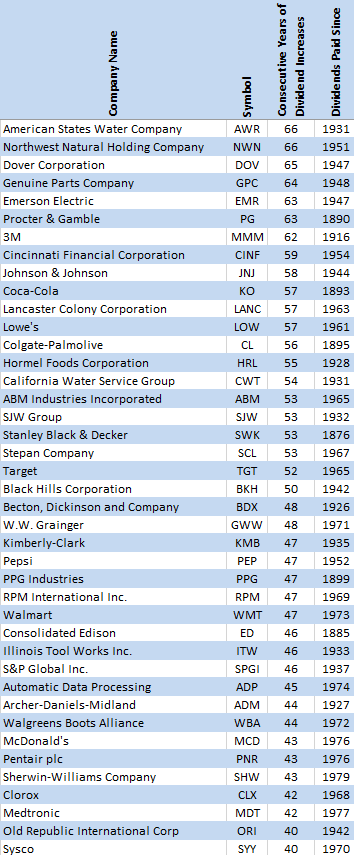

Dividend history gives you confidence

Dividends are not guaranteed, however you can look at history and have a high degree of confidence that companies like the ones shown below will continue to pay you a dividend and, continue to increase their dividends in the future.

Dividends protect against inflation

For example, if the annual inflation rate is 4% and your stock price only went up by 3% you incurred a loss of 1%. However, if that same stock gives you a 3% dividend yield your investment has actually outpaced inflation, your purchasing power has been protected. A dividend increase will also increase your purchasing power .

With Index/ETF funds you are still paying fees

The fees for Index Funds and ETFs are much lower than fees for actively managed mutual funds, but there are still fees to be paid by you. If you are investing small amounts of money the fees may seem insignificant, but when you start investing $100K, $300K, $500K or over $1M, the fees will start to negatively impact you.

Here is a list of some sample funds and their fees:

- Vanguard High Dividend ETF (VYM): 0.06%

- Vanguard S&P 500 ETF (VOO): 0.03%

- Vanguard International High Dividend (VYMI): 0.32%

The following values are used to determine the fees for each of the funds:

Total invested: $200,000

Investment held for: 20 years

Front end sales fee: 0%

Past return: 13.8% (Vanguard S&P 500)

Fees paid after 20 years:

- VYM: $11,488.33

- VOO: $5,743.25

- VYMI: $61,356.19

- Individual stocks: $175

$500,000 invested for 25 years in VYM would cost you $57,068.32 in fees.

With mutual funds, the fees are even higher. Here's the cost of investing $300,000 in a mutual fund where the fee is 2.2%:

- $120,474 would be lost to fees after 10 years

- $471,810 would be lost to fees after 20 years

- $1,390,658 would be lost to fees after 30 years

With Index/ETF funds you are inadvertently buying overvalued stocks

Let's take a look at the number of companies (stocks) held in each of these funds:

- VYM: 406 companies

- VOO: 511 companies

- VYMI: 995 companies

On any given day not all of the companies in these funds are going to be undervalued (priced low).

When you buy an index fund your money goes to buying both undervalued and overvalued stocks. Therefore you are inadvertently buying stocks that are priced high, those stocks have limited potential to go up even higher since they are already priced high, in the long-term this will negatively affect your portfolio's performance.

With Index/ETF funds you are inadvertently buying non-quality stocks

A quality company is one that passes all of the 10 SI Criteria.

Would you buy a company that had 500% debt, or P/E of 275, or wasn't profitable? If you wouldn't buy even one poor performing company then why would you buy it as part of a larger Index Fund or ETF? With these types of funds your are inadvertently buying non-quality companies.

With Index/ETF funds your dividend yield is lower

Let's take a look at the current dividend yields of each of these funds:

- VYM: 3.16%

- VOO: 1.97%

- VYMI: 4.24%

Now let's take a look at the current dividend yields of a few quality companies:

- Enbridge: 6.15%

- Simon Property Group: 5.56%

- The Gap: 5.52%

- AT&T: 5.33%

- Power Corporation: 5.33%

- BCE: 5.05%

- Ryder System 4.67%

- TC Energy: 4.52%

The yield for the funds is lower for two reasons:

- they are invested in companies that pay very little dividends (some companies only yield 0.5%)

- in the case of VOO they are invested in some companies that don't pay any dividends

Would you rather earn 1.97% on your investment or earn 5%?

$200,000 invested over 10 years (assuming no stock price appreciation to keep the math simple), with dividends re-invested with a 1.97% yield, you would earn: $43,082.78 in dividends

$200,000 invested over 10 years (assuming no stock price appreciation to keep the math simple), with dividends re-invested with a 5.00% yield, you would earn: $125,778.93 in dividends

In the long-term the dividend yield you earn matters.

With Index/ETF funds you'll eventually have to start selling your shares

With Index/ETF funds you'll eventually have to start selling your shares, especially with funds like VOO, or similar ones that hold stocks in companies that don't pay dividends or pay very little dividends. Your living expenses, vacations, homes, cars, boats, clothing, food, giving to charities, education, healthcare all cost money, you cannot pay for these things with stocks. You have to cover your expenditures with cash, you can only do this by using dividends or selling some of your shares. This becomes a bigger issue the longer you live, if you just need 5, 10, or 15 years to live off your investments you might be fine selling your shares in index funds or ETFs.

However if you need to live off your investments for 20, 30, 40 years, or would like to leave your kids/family with a solid investment portfolio, then selling shares in your index funds could eventually lead to you having to sell off all your shares, resulting in no investment portfolio at all. The situation become worse if we are hit with a recession (or downturn) that lasts 5-7 years. During a downturn you still need to live and pay for things, so you start to sell some of your shares in your index funds, the problem is in a market downturn shares prices are already low (this is the worst time to sell), you end up selling more shares (just to cover your costs), which further shrinks your portfolio.

With individual investing, we do not sell our shares, we design our portfolio to maximize on growing passive income. What happens to the dividend when stock prices drop? What happens to the dividend when there is a recession? The dividend continues to go up (see an example of increasing dividends).

Unpredictable dividend income from Index/ETFs

The Vanguard High Dividend Yield ETF (VYM) is invested in more than 400 companies – certainly not all of their dividend payments will be safe throughout a full economic cycle.

The VYM fund’s dividend payments were negatively affected during the last recession. Total dividend payments reached $1.44 per share in 2008 before falling to $1.17 in 2009 and $1.09 in 2010, representing a high-to-low decline of about 25%. Annual dividend payments didn’t recover back to their 2008 peak until 2012.

Put another way, if a retired investor owned 25,000 shares of VYM, she would have received $36,000 of dividend income in 2008.

By 2010, her annual dividend income had fallen to about $27,000 – a drop of more than $725 per month. Depending on her budgeting, margin of safety, living expenses, her life could suddenly have become much more difficult.

VYM's price also fell by more than 32% in 2008, likely invoking plenty of fear as the value of her nest egg fell from $1,000,000 to less than $700,000. To be fair, even with individual stocks your prices will drop during a recession. However the key here is not the stock price but the income being generated from your portfolio. With individual stocks you can pick and choose the best reliable dividend companies, to ensure that your dividend income is safe and continues to grow even during a recession. How can you ensure growing dividend income? By focusing on buying companies that have a history of consecutively increasing dividends (see an example of increasing dividends in the previous question above).

Over diversification is a problem

Over diversification can be a problem, because when you purchase hundreds (or thousands) of companies via an Index Fund or ETF, there is a higher likelihood that you will:

- buy companies that overvalued (priced high)

- buy companies that are not quality companies

- buy companies that don't pay dividends or very little dividends

George Athanassakos is a professor of finance and holds the Ben Graham Chair in Value Investing at the Richard Ivey School of Business at the University of Waterloo wrote, "In recent years, a large number of mathematicians and finance PhDs working on Wall Street and their models were proven wrong because they put too much emphasis on bell curve probability distributions and diversification. Value investors have concentrated portfolios, not because they reject diversification, but rather they operate withing the boundaries of their competence; they select only securities [stocks] they understand."

✔ dividends provide an immediate return on your investment, regardless of stock price fluctuations

✔ dividends provide cash in your pocket, you can spend the money if you wish or re-invest it

✔ once given out dividends cannot be taken back, if your company declines (or goes bankrupt) the dividends you've received over the years are yours to keep

✔ over time dividends reduce your risk, by increasing your margin of safety (see an example of increasing dividends)

✔ the Simply Investing Approach is simple, safe, and effective, it takes the guesswork out of selecting the right stocks

✔ the focus of our approach is building a growing stream of passive income from dividends

✔ dividends help you stay the course, they help you remain patient and disciplined

✔ some clients are earning 20, 30, $50K per year or more in dividends, dividends can eventually cover your living expenses

The Simply Investing approach saves you time in 3 ways:

- The Simply Investing Course contains my over 20 years of experience as a dividend investor. I spent a decade interviewing investors, reading books, researching, and thru trial and error developed this approach. You can save time (at least a decade) and money (I spent thousands in training) by taking the Simply Investing Course and learning from my mistakes. The Course can be completed in half a day, and you can get started with investing immediately.

- The Simply Investing Course covers the 12 Rules of Simply Investing, and provides you with the tools (Google Sheet, Reference Guide, Bonus Videos) to get started right away. The 12 Rules save you time, by becoming a checklist, that you use to help you quickly select the best dividend stocks.

- The Simply Investing Platform saves you even more time by doing the research for you. Each day the Platform applies the SI Criteria to over 6000 stocks, it then shows you which stocks to consider for investing and which ones to avoid. The Platform can also notify you by email when a stock passes the ten SI Criteria and is priced low.

Investing risk comes from a lack of knowledge, not knowing what to invest in or avoid, and not knowing how to handle market downturns. Our approach to investing reduces your risk in the following 3 ways:

- The Simply Investing Course gives you the investing knowledge so that you can quickly discover quality stocks that are priced low.

- The Simply Investing Course covers the 7 types of investing risks, and how to avoid them. The Course also covers how to build a resilient portfolio, regardless of what happens in the economy.

- The 12 Rules of Simply Investing are designed to keep you from making mistakes, and guide you towards companies that are profitable, safe, reliable, are financially healthy, and have a history of paying shareholders with growing dividends.

Short answer: No

Long answer: The Simply Investing Approach is a long-term strategy for investing in dividend stocks. In the short-term stock prices and stock markets fluctuate. However, in the long-term (5-10 years or more) the stock market can provide great returns.

I teach in the Simply Investing Course that any money you need in less than 5 years should not be invested in stocks (that includes mutual funds, index funds, and ETFs). Imagine you are saving to buy a house/car/vacation and you invest $20,000 in the stock market, what happens if the value of the stocks drops to $14,000 in 2 years, and you need the money in 2 years? This is not a great position to be in, you should not be forced to sell your investment at a loss because you need the money.

You should have a long-term horizon so that you can ride out any market downturns. Therefore it's best to stay invested for at least 5 to 10 years or more. The longer your time horizon, the more you can take advantage of compounding, and growing dividends.

Quick story: In 2001 I invested $2479 in 185 shares in TC Energy for $13.10 each, the dividend at the time was $0.80/share. Today the dividend is $3.48/share, since then I have received over $7300 in dividends alone from this company. My risk with respect to my investment in TC Energy is 0% today. My dividend yield based on the purchase price is now 26%. All this is only possible if you stay invested for the long term.

Value investing is not new. In fact Benjamin Graham, who was Warren Buffett's teacher at Columbia University, first wrote about it in 1934. Investors all over the world have applied the value investing concept and reaped huge rewards.

Derek Foster was able to retire at the age of 34. John Greaney retired at the age of 38. Warren Buffet – the most famous of value investors – has been on the Forbes list of the richest people in the world for decades.

Having practiced dividend value investing for more than 20 years, my own investments continue to have great returns. Click here to view my results. The list of successful value investors is long; here's a short sample list:

- Peter Lynch

- Geraldine Weiss

- Sir John Templeton

- Mohnish Pabrai

- Charlie Munger

- Prem Watsa

- Benjamin Graham

- Stephen A. Jarislowsky

Since 1964 Warren Buffett has been able to increase the book value of shares in his company by 3,641,613%. Therefore I believe he is the best person to answer the following question:

Question: If value investing is so easy, why isn't everyone doing it?

Answer:

"I can only tell you that the secret has been out for 50 years, ever since Ben Graham and Dave Dodd wrote Security Analysis, yet I have seen no trend toward value investing in the 35 years I've practiced it. There seems to be some perverse human characteristic that likes to make easy things difficult. The academic world, if anything, has actually backed away from the teaching of value investing over the last 30 years. It's likely to continue that way. Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace, and those who read their Graham & Dodd will continue to prosper."

The above comment was taken from a speech Warren Buffett gave at Columbia Business School May 17, 1984 marking the 50th anniversary of Security Analysis.

Discrepancies between price and value will make certain stocks undervalued (priced low) at times or overvalued. The key is to invest in quality undervalued stocks. My mission is to teach you how to know when a stock is a quality stocks and when its undervalued or overvalued. The process is quite simple and easy to implement, even though people think that it needs to be complicated in order to make money.

Forget conventional wisdom and use common sense, in my Simply Investing Course I teach you a few simple set of rules that are designed to make a you better investor. Take my online course today, and learn how value investors continue to prosper while the majority of folks continue to waste money on the latest investing fads, and paying fees on funds (mutual funds, index funds, ETFs).

One of our clients Tracy saved more than $1.3 million dollars in mutual fund fees alone, and grew her passive income by 74% (in a single year) after implementing the Simply Investing approach.

Your ultimate tool for finding the best stocks

The SI Platform does the work for you, by automatically applying our quality SI Criteria to over 6000 stocks daily, and then giving each stock an SI Grade out of 10.

![]()

Disclaimer: Kanwal Sarai is not an investment advisor, certified financial planner, or broker. Kanwal Sarai is an educator and dividend value investor, and has been for more than two decades. The information provided here is for educational purposes. My opinions are based upon information that I consider reliable, but I do not warrant its completeness or accuracy, and it should not be relied upon as such. The statements and opinions on this newsletter/course/report/video/website/presentation are subject to change without notice. I may personally hold securities mentioned in this course/website/report/video/newsletter. The final decision to buy or sell any stock is yours; please do your own due diligence. Stock buy or sell decisions are based on many factors including your own risk tolerance. When in doubt please consult a professional advisor. No advice on the buying and selling of specific securities is provided. Past performance is not a guarantee of future results. You should not rely on any revenue, sales, or earnings information we present as any kind of promise, guarantee, or expectation of any level of success or earnings. Your results will be determined by a number of factors over which we have no control, such as your financial condition, experiences, skills, level of effort, education, and changes within the market. The names of actual companies or products mentioned herein may be the trademarks of their respective owners. View the complete Terms of Use.