Do you know how to avoid bad stocks?

It's important to know how to identify great stocks, but it's just as important to know how to identify bad stocks so you can avoid them. In this article I'll show you how to identify and avoid lousy stocks.

It's important to know how to identify great stocks, but it's just as important to know how to identify bad stocks so you can avoid them. In this article I'll show you how to identify and avoid lousy stocks.

Will the company be around in 20 years?

Think about the products and services provide by a company before you invest in it. Will those products and services still be in demand 20 years from now? If not, then don't invest your hard earned money in a company that might not be around for the long-term. What do the following 5 products have in common?:

- Polariod instant cameras

- Atari

- Palm Pilot

- Pet Rock

- Fidget Spinners

The above no longer exist or the fads have disappeared long ago, and the companies behind them have also vanished.

Is the company recession proof?

Do not invest in companies that aren't recession proof. When the next recession hits, companies that sell cars, vacations, and airlines will drop in value. Imagine you invested your money in car manufacturers, airlines, and tourism stocks, and just when you were about to retire or needed your money, a recession wiped out 50% of your investments, a recession is the worst time to sell your stocks. Invest in recession proof companies likes food retailers, utilities, and healthcare industries so that you don't need to worry about the next recession.

Does the company have a history of profitability?

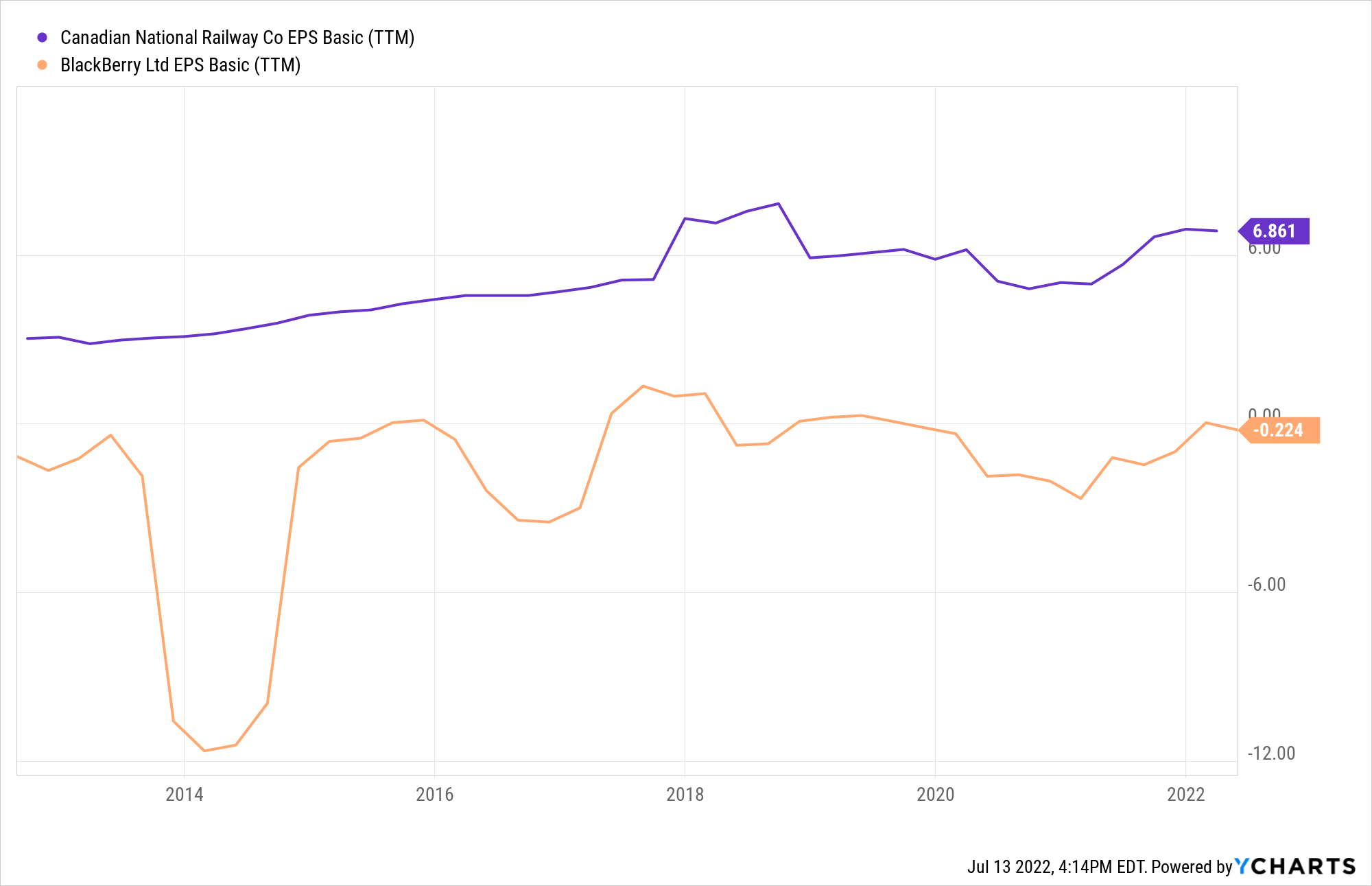

Earnings per share (EPS) are the profits that a company earns. Therefore it's important to look at the EPS history before you invest in a stock. Take a look at the EPS (over the last 10 years) of the following two companies CNR and BlackBerry:

From the above graph you can see that BlackBerry has been consistently unprofitable (EPS is negative), whereas CNR remains profitable each year. No one can predict the future, but I can look at the above graph and have a high degree of confidence that CNR will continue to be profitable in the long-term.

Does the company have a history of dividend growth?

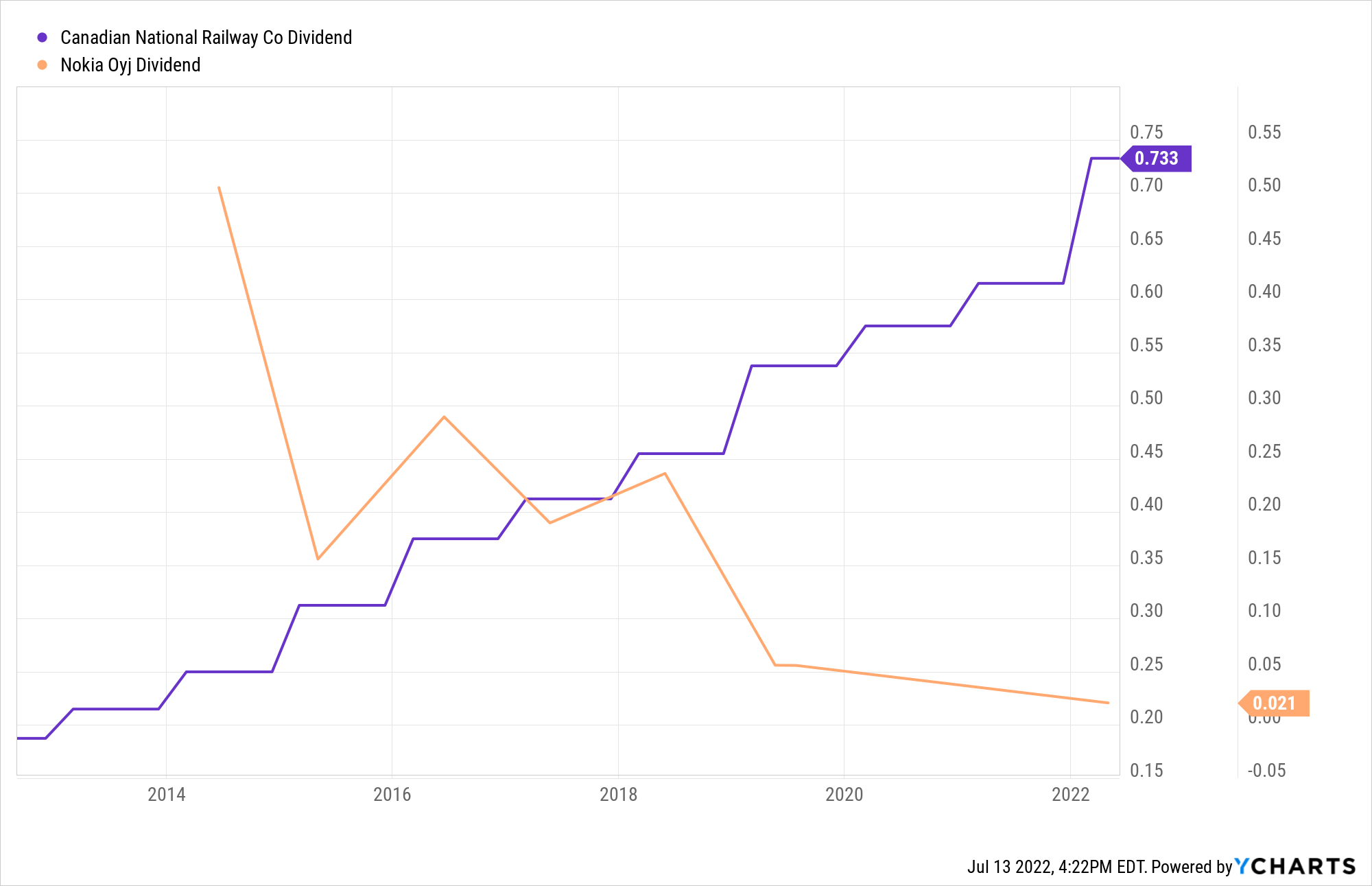

As an investor what is most important to you is the dividend income. Dividends are regular cash payments made to shareholders, you get paid just for owning shares. Therefore you want to ensure that your dividend income will grow each year. Take a look at the dividends (over the last 10 years) of the following two companies CNR and Nokia:

From the above graph you can see that CNR has been consistently increasing it's dividend, whereas Nokia has been decreasing it's dividend. No one can predict the future, but I can look at the above graph and have a high degree of confidence that CNR will continue to pay dividends and increase them in the future, which means more money for CNR shareholders.

Can the company afford to pay the dividend?

The dividends per share are paid out from a company's earning per share (EPS). Take a look at these two examples:

- Company ABC earned $3.45/share and paid a dividend of $1.15/share

- Company XYZ earned $2.21/share but paid a dividend of $3.22/share

Company ABC has a payout ratio of ($1.15 / $3.45) 33%, which means it paid 33% of it's earnings to shareholders in the form of a cash dividend. 33% is a healthy payout ratio, it means the company has room to increase it's dividend in the future.

On the other hand, Company XYZ has a payout ratio of 146%, where did it come up with the cash to pay it's dividend? The company probably had to borrow money in order to pay the shareholders. A payout ratio of 146% is not sustainable, the company might have to reduce it's dividend in the future, which means less money for shareholders.

Do not invest in any company with a payout ratio of more than 75%.

Does the company have low debt?

Take a look at the example below, which company would you invest in?:

- Company ABC has 2% debt

- Company XYZ has 789% debt

All things considered equal, it would be better to invest in Company ABC and avoid Company XYZ. Companies that have high debt will have a very hard time paying off the debt (and the interest payments) during a recession. Companies with low debt are in a stronger financial position.

Do not invest in any company with a debt level higher than 70%.

Is the stock priced high or low?

Avoid investing in companies when their stock price is high (overvalued). If a stock is overvalued at $85, there is no point in buying it for $85 or more because the likelihood of the price going higher is very low. However, if a stock is undervalued at $25, there's a good chance that in the long run the stock price will exceed $25. Avoid stocks where:

- the P/E ratio is greater than 25

- the current dividend yield is lower than the stock's average dividend yield

- the P/B ratio is greater than 3

Stay away from bad stocks

Now you know how to identify bad stocks, and avoid making investing mistakes. Want a quick way to identify great stocks? Just apply the 12 Rules of Simply Investing listed below, remember a stock must passes all the 12 Rules in order to be considered a great stock:

1. Do you understand the product or service offered by the company?

2. Will people still be using this product or service in 20 years?

3. Does the company have a low-cost durable (lasting) competitive advantage?

4. Is the company recession proof?

5. Ensure the company is profitable, check the following two EPS parameters:

a. 20-year average EPS growth must be at least 8% or more.

b. The EPS must have increased at least 8 times in the last 20-years.

6. 20-year average dividend growth must be at least 8% or more.

7. Payout ratio must be 75% or less.

8. Debt must be 70% or less.

9. Has there been a recent dividend cut? Avoid companies with a recent dividend cut.

10. Does the company actively buy back its shares?

11. Ensure the stock is priced low (undervalued):

a. P/E ratio must be 25 or less.

b. Current dividend yield must be higher than its (20-year) average dividend yield.

c. P/B ratio must be 3 or less.

12. Keep your emotions out of investing.

The 12 Rules of Simply Investing are time tested and designed to keep you from making mistakes. Investing really can be this simple.

I'm here to help

I can help you to start investing today and focus on selecting the right dividend stocks when they are priced low (undervalued), why re-invent the wheel when you can learn from my 20-years of being in the stock market. I've witnessed first hand the ups and downs of the market, and I know what it's like to start investing your hard earned money. Follow my approach to investing to help you get started right away, so you don't have to wait on the sidelines any longer. I also built the ultimate tool (that I wish I had when I started investing in1999) to help dividend investors focus on quality stocks for long-term growth. The sooner you start investing the sooner you will be on your path to financial freedom.

Did you enjoy reading this article? If so, I encourage you to sign up for my free newsletter and have these articles delivered via email once a month … for free!

Learn how you can avoid the most common (and costly) investing mistakes, download my free guide today: "Are you making these top 5 investing mistakes?"

0 comments

Leave a comment